Managing accounting work is not only about numbers. It is also about organizing tasks, tracking deadlines and making sure nothing falls through the cracks. Many professionals note that most tools focus either on tasks or on accounting, but rarely both.

This is why flexible platforms like GoodDay are often chosen for managing accounting-related tasks alongside budgets, costs, and financial reporting in one workspace.

In this guide, we’ll explore the best accounting task management software to help you make the best choice.

But if you have any questions that are not covered in this article, you can always connect with our team via info@goodday.work

Best accounting task management software (shortlist for 2026)

Best accounting task management software combines task tracking with features that fit accounting workflows such as recurring jobs, client communication, and compliance-driven deadlines. Here are some of the top accounting task management platforms in 2026:

- Best for General Project Management and Accounting: GoodDay, Asana and ClickUp offer highly customizable, flexible, and visual project tracking suitable for teams that prefer non-niche tools.

- Best Overall for Firms: Karbon is designed specifically for accounting, offering excellent email integration, workflow automation, and client tasks.

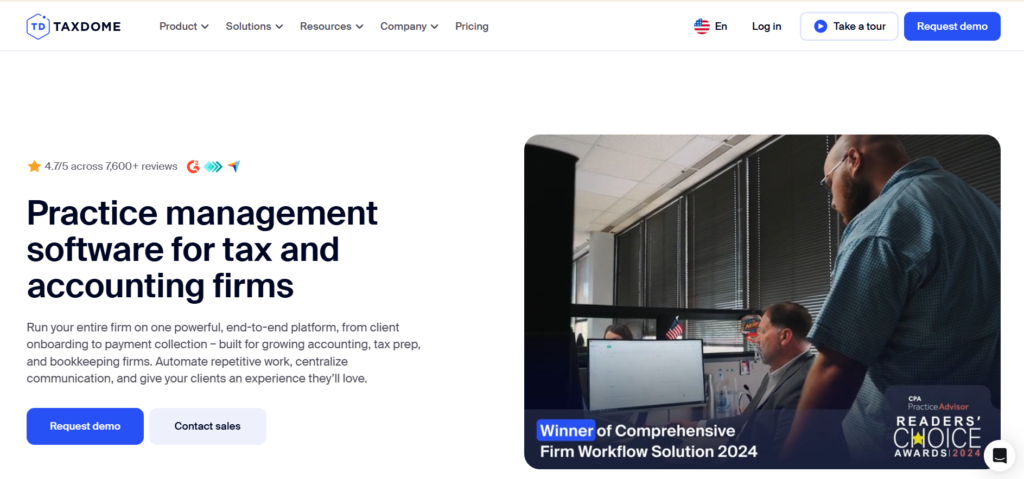

- Best for Tax Practices: TaxDome offers an all-in-one solution with document management, client portals, and secure messaging.

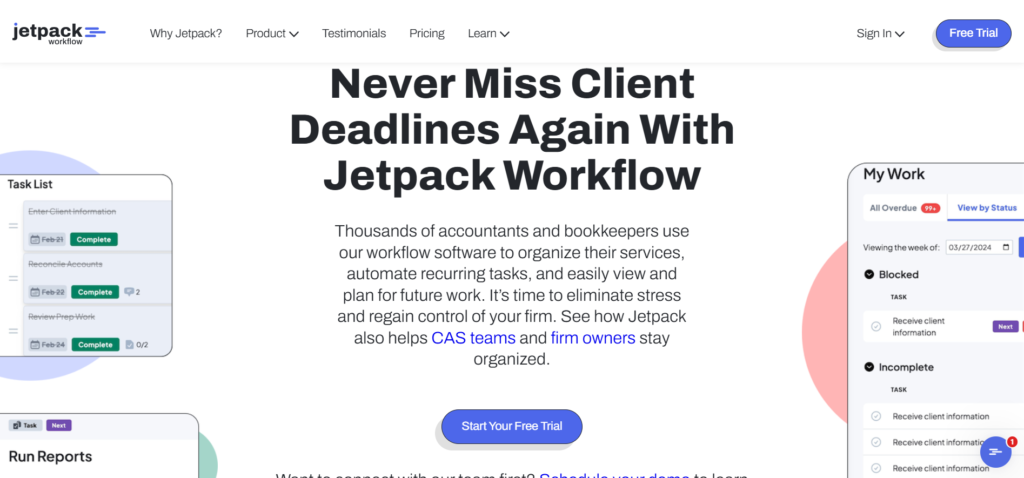

- Best for Workflow & Deadlines: Jetpack Workflow focuses heavily on recurring tasks and tracking deadlines for compliance work.

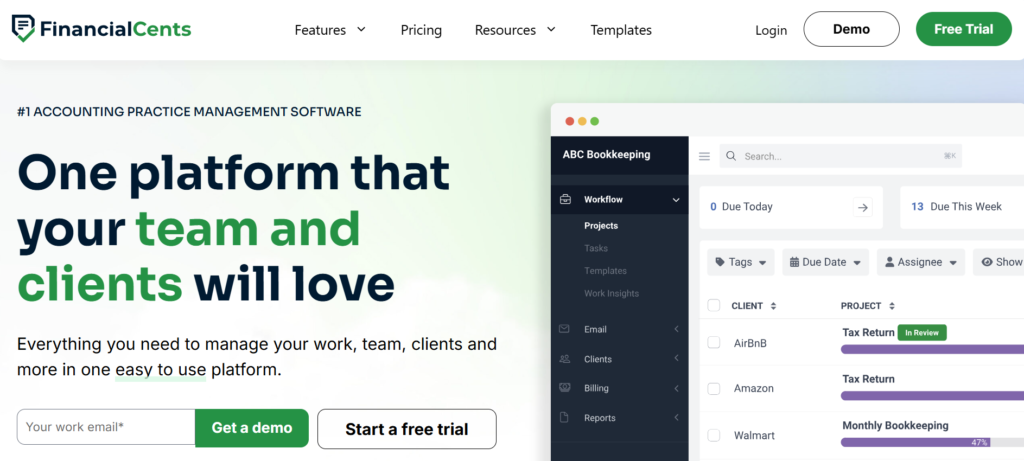

- Best for Small Firms/Bookkeepers: Financial Cents is praised for its ease of use and ability to manage client work efficiently.

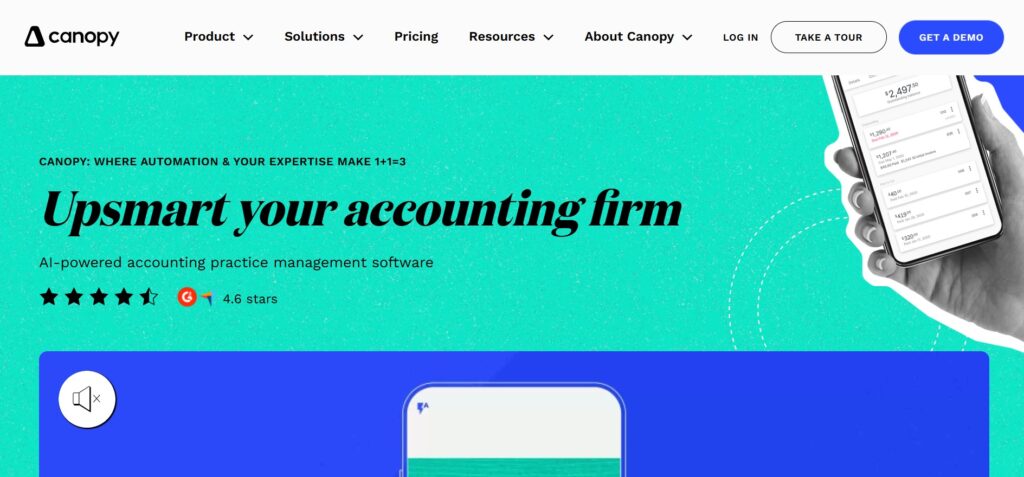

- Best for Practice Management: Canopy Practice Management provides robust tools for managing client files and workflows.

- Best for Client Collaboration: Pixie and Senta are strong contenders for client management and compliance tracking.

Comparison of the best accounting task management software in 2026

Let’s compare some of the leading accounting task management tools. Please keep in mind that pricing may change depending on billing cycle, region, promotions, and custom contracts.

| Software | Best for | Pricing |

| GoodDay | General project and task management with accounting workflows | Free up to 15 users; Professional at $4 per user/month; Business at $7 per user/month; Enterprise custom |

| Asana | Structured task and project management for teams | Free; Starter $10.99 per user/month billed annually; Advanced $24.99 per user/month billed annually |

| ClickUp | Flexible and customizable task and workflow management | Free; Unlimited about $7 per user/month billed annually; Business about $12 per user/month billed annually |

| Karbon | Accounting specific workflow and email based practice management | Team $59 per user/month billed annually; Business $89 per user/month billed annually |

| TaxDome | Tax and accounting practice management with client portal | Solo about $800 per user/year; Pro about $1,000 per user/year; Business about $1,200 per user/year |

| Jetpack Workflow | Workflow and deadline tracking for accounting firms | From about $45 per user/month (lower on annual billing) |

| Financial Cents | Small firm and bookkeeping practice management | Solo $19 per user/month; Team $49 per user/month; Scale $69 per user/month |

| Canopy Practice Management | Client files, workflows, and practice management | Workflow module about $35 per user/month plus optional add-ons |

| Pixie | Client collaboration and practice workflow | Flat monthly fee based on number of clients |

| Senta | Accounting compliance and client workflow | About £29 per user/month (USD varies by exchange rate) |

Overview of the best accounting task management software

Let’s review leading accounting task management tools and examine how each one supports real accounting workflows, from daily tasks to long term client work and compliance. Here are some of the most reliable and cost effective platforms for accounting and finance teams:

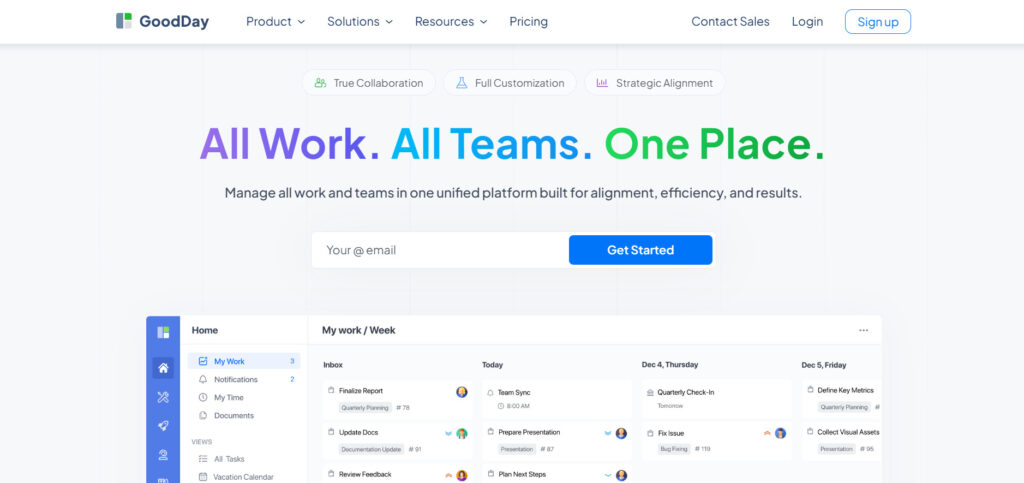

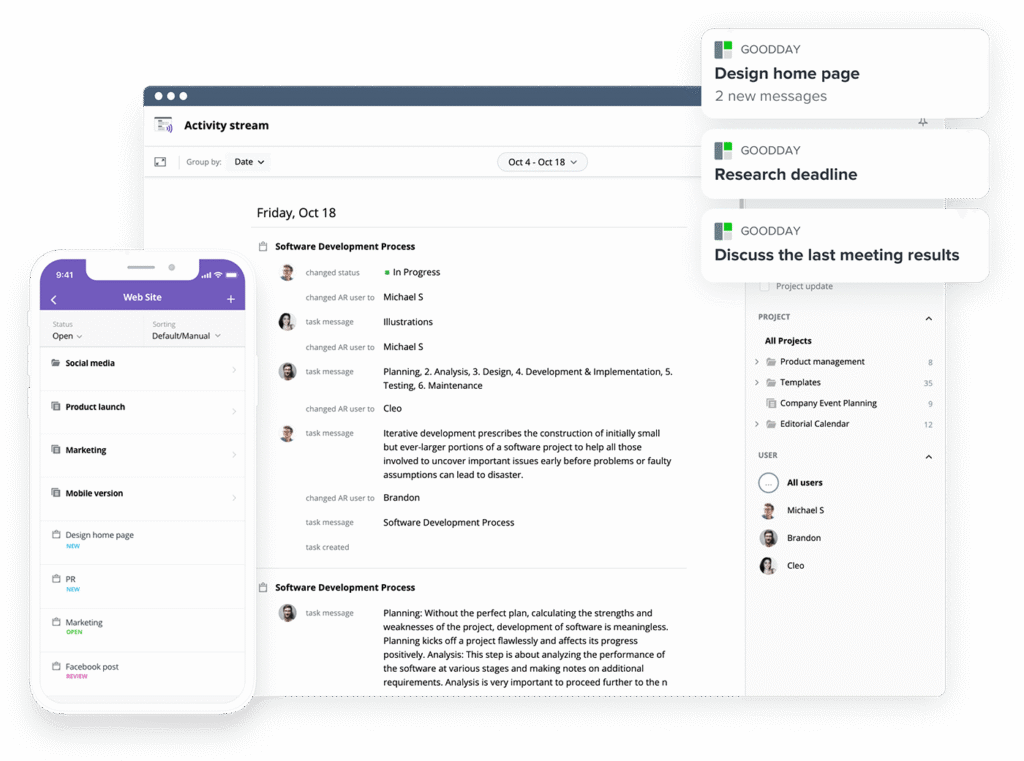

GoodDay

GoodDay is a powerful work management software used by Fortune 500 companies, startups, and small businesses all over the world. It provides a free plan with unlimited projects for up to 15 users and makes advanced productivity features available earlier than most competitors. In 2026, GoodDay is listed in 12 Capterra shortlists as a top rated software.

Why accounting teams use it

Accounting teams use GoodDay to manage recurring work, client projects, and internal operations in one system. The platform offers multiple views (like Gantt charts and Kanban boards), allows unlimited project hierarchy, includes built-in time tracking, offers full CRM functionality, and applies modern security standards.You can use GoodDay’s expense tracking template to organize all team or project expenses, upload receipts, categorize costs, and view them in a list so you can easily see where your money is going.

Main features

GoodDay stands out because it combines a wide range of professional tools with pricing that remains accessible for small and mid sized teams.

- Project and task management

- Planning and visualization

- Time and resource management

- Financial and client management

- Custom workflows, approvals and automation rules

- Notifications and alerts

- Reporting and analytics

- Security and access control

Integrations

GoodDay connects directly with Google Workspace tools such as Gmail, Google Docs, Google Drive, and Google Calendar, as well as Slack, Dropbox, Box, GitHub, GitLab, and email. It also links to more than 1,300 business applications through Zapier and provides an API to integrate with internal or custom systems.

Desktop and mobile capabilities

GoodDay works across Windows, Mac, and Linux desktops and is also available on iOS and Android. This allows users to manage tasks, projects, and dashboards both from office environments and while working remotely or on the move.

Pros and cons

| Pros | Cons |

| Used by over 100,000 teams worldwide | Advanced reports need initial setup |

| Wide set of features for planning and tracking | Workflow customization takes time to fine tune |

| Free plan for up to 15 users | Learning advanced features requires training |

| No forced upsells or hidden pricing | High flexibility may slow early adoption |

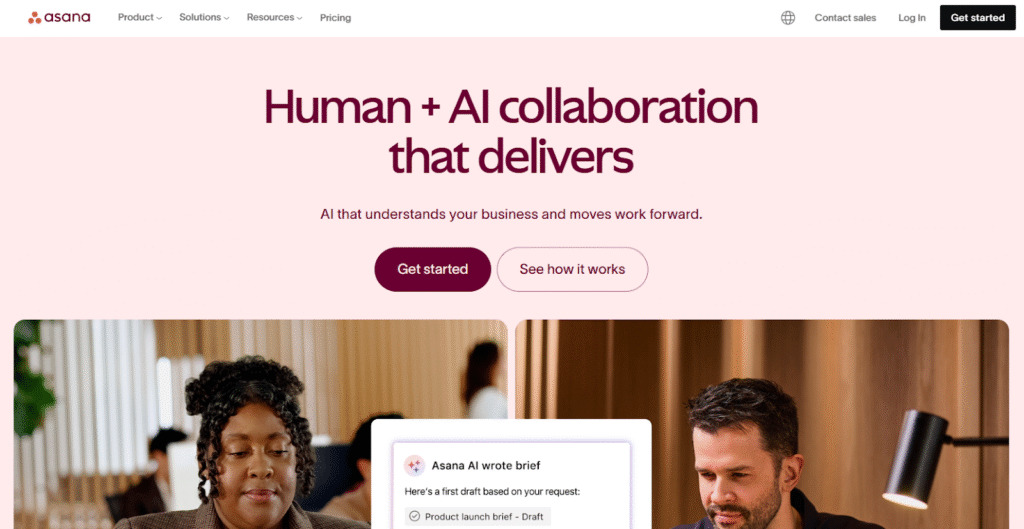

Asana

Asana is a widely used work and project management platform that helps teams organize work from daily tasks to long term strategic goals. It supports task lists, projects, timelines, calendars, and custom workflows, and integrates with hundreds of business apps. Teams can use boards, lists, and timeline views to track progress, automate routine steps, and see work status in real time.

Why accounting teams use it

Accounting teams use Asana to organize cross department work, align deliverables with deadlines, and centralize communication. Its flexible project views help coordinate recurring tasks like month end close, audit prep, and ad hoc client requests.

Main features

Asana is known for its intuitive interface and project centric feature set.

- Task, project, and goal management

- Timeline and calendar views

- Automation for recurring work

- Real time reporting and dashboards

- Team collaboration and comments

- File attachments and activity tracking

Integrations

Asana connects with Microsoft Teams, Slack, Google Drive, Outlook, and Salesforce to keep work data synced across systems.

Desktop and mobile capabilities

Asana is available via web browser and has dedicated mobile apps for iOS and Android, letting teams update tasks and view status on the go.

Pros and cons

| Pros | Cons |

| Easy to use and intuitive interface | Limited accounting specific features |

| Strong task and deadline tracking | Advanced reporting requires higher plans |

| Good cross team collaboration | Can become costly for large teams |

| Large ecosystem of integrations | Not built specifically for accounting |

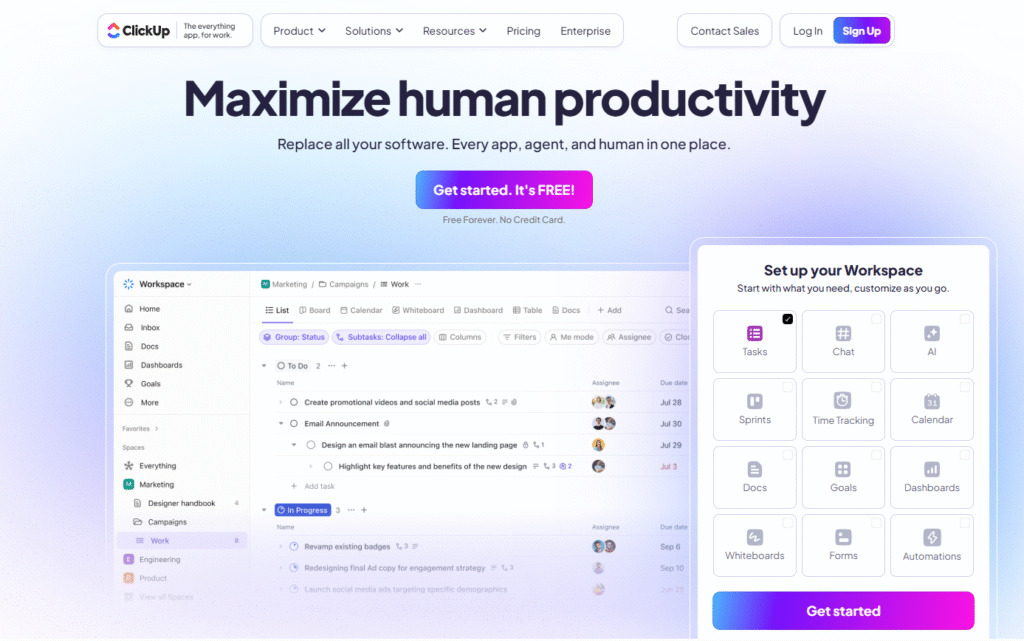

ClickUp

ClickUp is an all in one work management platform that combines tasks, docs, goals, chats, and workflow automation in one place. It is designed for a wide range of industries and use cases, including complex project work and operational tracking. ClickUp supports multiple views such as lists, Kanban, calendars, and dashboards.

Why accounting teams use it

Accounting teams choose ClickUp to unify job tracking, documentation, approvals, and team chat in a single workspace. It helps automate recurring task steps and centralize client work without switching tools. Finance teams can model processes such as client onboarding, invoice approvals, or expense reviews in a way that fits their specific structure.

Main features

- Task and project management

- Custom dashboards and workflows

- Built in documents and collaboration

- Goal and time tracking

- Automation and reminders

- Chat and whiteboards

Integrations

ClickUp connects to Slack, Google Drive, Microsoft Teams, GitHub, and many other tools.

Desktop and mobile capabilities

ClickUp has web access, desktop clients, and mobile apps for iOS and Android so teams can update tasks and view dashboards anywhere.

Pros and cons

| Pros | Cons |

| Very flexible and customizable | Interface can feel complex |

| Many features in one platform | Setup takes time |

| Good value for price | Can overwhelm small teams |

| Strong automation | Performance varies with large data |

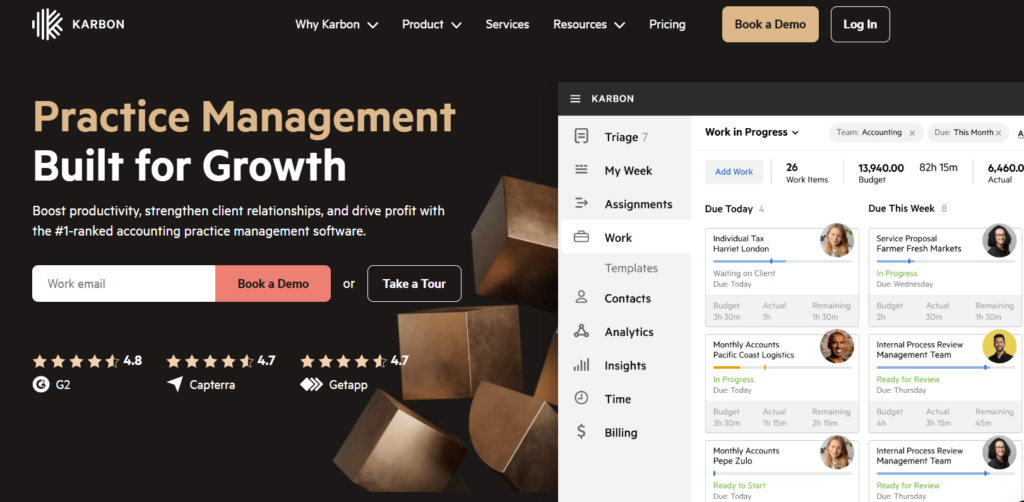

Karbon

Karbon is practice management software built specifically for accounting firms. It combines email, tasks, workflows, and team collaboration in one platform designed around accounting processes.

Why accounting teams use it

Accounting firms use Karbon to bring emails, tasks, and workflows together instead of keeping them scattered across inboxes and spreadsheets. Firms rely on Karbon to standardize how work moves through the organization, from client requests to delivery and review, which is critical for maintaining quality and meeting deadlines.

Main features

- Accounting workflow templates

- Email and task integration

- Client engagement tracking

- Document organization

- Calendar sync and alerts

Integrations

Karbon integrates with calendars and productivity tools to support daily firm operations.

Desktop and mobile capabilities

Karbon is accessible through web browsers and supports mobile use for reviewing and managing work.

Pros and cons

| Pros | Cons |

| Built for accounting firms | Higher price than general tools |

| Strong email integration | Less flexible outside accounting |

| Improves workflow visibility | Smaller integration ecosystem |

| Good task standardization | Limited customization |

TaxDome

TaxDome is an all in one practice management platform designed for tax professionals, accountants, and bookkeeping firms that want to centralize their operations. It combines client management, workflow tracking, document handling, billing, and communication in a single system. TaxDome is particularly popular with small and mid sized firms that want a unified platform instead of managing multiple disconnected tools.

Why accounting teams use it

Accounting teams use TaxDome to manage the full client lifecycle, from onboarding and document collection to task execution and invoicing. Its secure client portal and built in automation reduce manual follow ups and repetitive communication. This makes TaxDome especially useful for firms handling a high volume of client interactions who want everything connected in one place.

Main features

- Client portal

- Document management and e signatures

- Workflow automation

- CRM and task tracking

- Invoicing and payments

Integrations

TaxDome connects with tax tools, scheduling systems, payment services, and Zapier.

Desktop and mobile capabilities

TaxDome is accessible via web and optimized for mobile browsers.

Pros and cons

| Pros | Cons |

| True all in one system | Less flexible for non tax work |

| Strong client tools | Dense interface |

| Built in billing | Higher cost for small firms |

| Good automation | Limited customization |

Jetpack Workflow

Jetpack Workflow is a workflow and deadline management tool built specifically for accounting and bookkeeping teams that deal with recurring work. Its core focus is helping firms organize repetitive client engagements, track deadlines, and ensure that compliance tasks are not missed. Instead of offering broad project management features, Jetpack is intentionally designed around accounting cycles.

Why accounting teams use it

Accounting teams use Jetpack Workflow to manage monthly, quarterly, and annual work such as tax filings, payroll, and financial reporting. Firms choose it because it makes deadlines highly visible and keeps recurring work structured and predictable. It is especially valuable for teams that want a system focused on execution and compliance rather than complex project planning.

Main features

- Workflow templates

- Recurring task automation

- Deadline tracking

- Task prioritization

- Team workload views

Integrations

Jetpack Workflow connects to many tools via Zapier.

Desktop and mobile capabilities

Jetpack Workflow is cloud based and works in any modern browser.

Pros and cons

| Pros | Cons |

| Excellent for deadlines | Limited general project features |

| Simple recurring workflows | Basic reporting |

| Reduces compliance risk | Not suited for other teams |

| Easy to use | Limited customization |

Financial Cents

Financial Cents is practice management software built for accounting, bookkeeping, and tax firms that want a simple and easy to use system for managing client work. It focuses on organizing workflows, tracking deadlines, and improving visibility across client engagements without requiring complex setup. Financial Cents is commonly adopted by small to mid sized firms that value clarity and speed over heavy customization.

Why accounting teams use it

Accounting teams use Financial Cents to centralize tasks, client communication, and workflow tracking in one place. It is often chosen by firms moving away from spreadsheets or email based task tracking who want a more structured but still approachable solution. Its design makes it accessible even for teams without dedicated operations or IT staff.

Main features

- Workflow and deadline tracking

- Client task management

- Communication tracking

- Reporting dashboards

- Client portal

Integrations

Financial Cents integrates with popular accounting and productivity tools.

Desktop and mobile capabilities

Financial Cents runs in web browsers and supports mobile access.

Pros and cons

| Pros | Cons |

| Easy setup | Limited automation |

| Built for small firms | Fewer enterprise features |

| Clean interface | Smaller integration set |

| Clear client tracking | Less customization |

Canopy Practice Management

Canopy is a cloud based practice management platform built for tax and accounting firms that want to manage client work, documents, and billing in one environment. It combines operational tools such as workflows and time tracking with client facing features like document sharing and communication. Canopy is typically used by firms that want a more comprehensive system to run their practice.

Why accounting teams use it

Accounting teams use Canopy to centralize client files, automate task routing, and manage billing alongside work delivery. It is especially useful for firms that want tighter integration between operational work and financial management. This makes Canopy a good fit for firms that are scaling and need better control over both service execution and revenue processes.

Main features

- Client management

- Document handling

- Workflow automation

- Time and billing

- Secure client portal

Integrations

Canopy integrates with tax and accounting tools and document platforms.

Desktop and mobile capabilities

Canopy works in browsers and supports mobile optimized access.

Pros and cons

| Pros | Cons |

| Strong document tools | Modular pricing adds cost |

| Built in billing | Interface can feel heavy |

| Good automation | Setup requires time |

| Centralized data | Less flexible for non tax work |

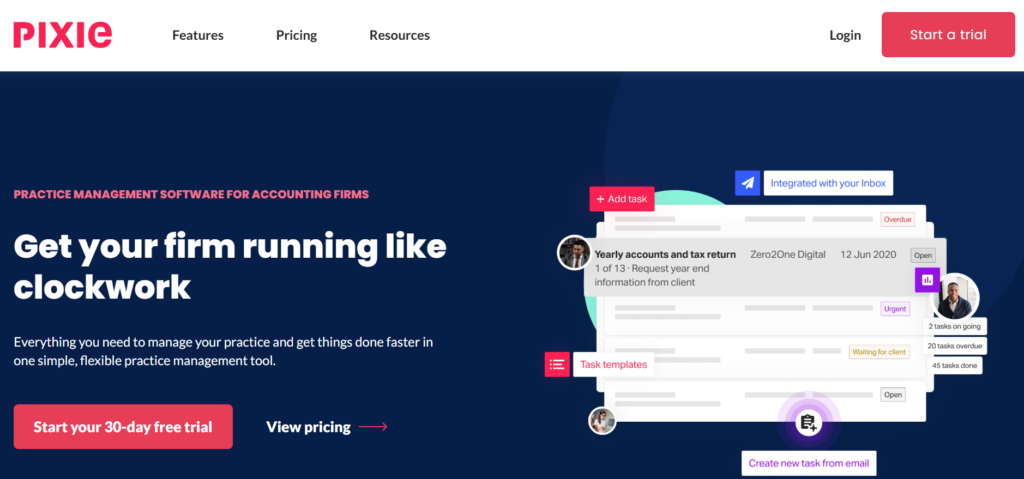

Pixie

Pixie is a practice management platform for accounting and bookkeeping firms focused on simplifying how client work is organized and tracked. It provides a centralized place for client records, tasks, documents, and communication, with an emphasis on ease of use and predictable pricing. Pixie is often chosen by firms that want to avoid complex software and prefer straightforward tools.

Why accounting teams use it

Teams use Pixie to manage client information, delegate tasks, and keep work organized without heavy configuration. Its pricing model based on the number of clients rather than users makes it attractive for firms that want cost predictability as their team grows. Pixie works well for firms that prioritize simplicity and transparency over advanced customization.

Main features

- Client records

- Secure client portal

- Document sharing

- Workflow automation

Integrations

Pixie integrates with common accounting systems and document tools.

Desktop and mobile capabilities

Pixie is web based and works on desktop and mobile browsers.

Pros and cons

| Pros | Cons |

| Predictable pricing | Limited advanced features |

| Simple interface | Smaller ecosystem |

| Good for client management | Not ideal for large firms |

| Easy to onboard | Fewer reporting tools |

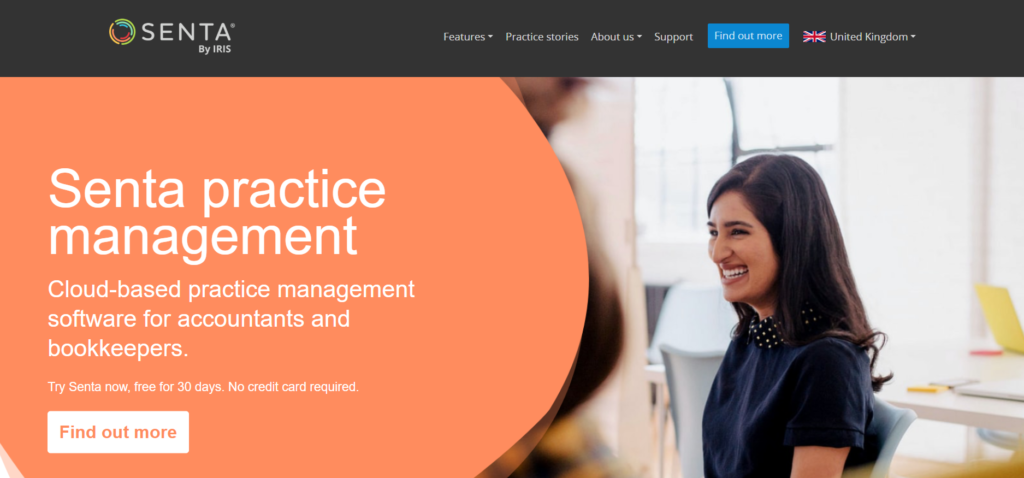

Senta

Senta is focused on helping accountants manage compliance, client relationships, and internal workflows. It is designed primarily for accounting and bookkeeping firms that need structured processes and consistent handling of client work. Senta is especially well known in the UK market and among firms that emphasize regulatory compliance.

Why accounting teams use it

Teams use Senta to centralize client data, automate recurring workflows, and manage compliance related tasks in a systematic way. It helps reduce manual follow ups and maintain visibility across all client engagements. Senta is often selected by firms that want strong workflow control combined with built in client management.

Main features

- CRM and client database

- Workflow automation

- Document portal

- Task and deadline tracking

Integrations

Senta integrates with tools like Xero and QuickBooks.

Desktop and mobile capabilities

Senta works in web browsers and supports mobile access.

Pros and cons

| Pros | Cons |

| Strong compliance focus | Mainly for UK firms |

| Good workflow automation | Limited outside accounting |

| Built in client CRM | Interface less modern |

| Useful integrations | Smaller global presence |

Paid vs free accounting task management software

Free accounting task management software options are useful for small teams, startups, and firms just starting to structure work. They typically include basic task lists, simple project boards, limited views (like list or board), and collaborative features that let teams assign work, comment on tasks, and track basic progress. Free versions often support a small number of users or projects and are ideal for teams that don’t yet need advanced planning tools or detailed reporting.

Paid solutions unlock the full power of work management by offering features that support scale, automation, and detailed oversight. These may include advanced scheduling tools like Gantt charts, recurring workflows, automated reminders, permissions and security controls, integrations with other systems, and analytics dashboards. For accounting teams that handle compliance deadlines, recurring client work, and cross functional coordination, paid plans provide stability, customization, and support that free versions do not.

Most important features of accounting task management software

Accounting task management software helps teams organize complex work, meet deadlines, and maintain visibility across clients and projects. The features below are the ones that matter most for making accounting teams efficient.

| Feature | How it works | How it helps teams be productive |

| Task management | Defines, assigns, and tracks tasks with statuses and priorities | Makes sure all accounting work is visible and owned, reducing dropped tasks |

| Project and client planning | Organizes work by client, project phase, or accounting cycle | Helps teams plan month end, audits, tax seasons, and client engagements |

| Recurring workflows | Automates repeat tasks on daily, weekly, or monthly cycles | Saves time on setup and reduces missed compliance and reporting deadlines |

| Deadline and milestone tracking | Visual cues, reminders, and alerts for due dates | Keeps recurring and one-off deadlines visible and prevents slips |

| Time tracking and timesheets | Records billable and internal hours with logs | Supports accurate billing, workload planning, and utilization reporting |

| Financial and expense tracking | Captures expenses, budget details, or project costs | Helps teams see real cost impacts and manage budgets for client work |

| Collaboration and commenting | Comments, mentions, and shared documents tied to tasks | Keeps communication in context and reduces email back and forth |

| Workflow automation | Rules and templates for approvals, status changes, notifications | Reduces manual steps for recurring accounting processes |

| Integration with accounting tools | Connects with calendars, email, drive, and accounting systems | Reduces double data entry and keeps work in sync with finance systems |

| Reporting and analytics | Dashboards and reports on workload, deadlines, time, and costs | Provides visibility into team performance, bottlenecks, and profitability |

How to select the best accounting task management software

Choosing the right software starts with being clear about what your team actually needs day to day, not just what looks impressive on a feature list. Some teams value deep customization or strong reporting tools, and many platforms offer free plans so you can test them before making a commitment. Here are the most important things to think about when making your choice.

Look at how your work really flows

Start by mapping how work moves through your team, from receiving a client request to completing and reviewing it. If your work is mostly recurring and deadline driven, tools with strong recurring workflows and deadline tracking will matter more than complex project planning. If you manage many one off projects, flexible task structures and views like Gantt or Kanban become more important.

Balance ease of use with flexibility

Some tools are very easy to start with but limited once your needs grow, while others offer deep flexibility but take time to set up. Think about how much time your team can realistically invest in configuring and maintaining the system. A tool that is slightly less powerful but easier to use can often bring better long term results than one that no one wants to maintain.

Make sure it supports accounting specific needs

General task tools can work for accounting, but they must handle things like recurring tasks, compliance deadlines, time tracking, and client based work. Check whether the software lets you structure work by client, period, or engagement and whether it supports approvals and reviews. These details matter much more in accounting than generic task lists.

Check integrations with tools you already use

Your task management software should not become another disconnected system. Make sure it integrates well with your email, calendar, document storage, and accounting or billing tools. Good integrations reduce double work and make it easier for the team to adopt the new system naturally.

Think about how your team will grow

The tool you choose should still make sense when your team is larger or your service mix changes. Look at pricing models, user limits, and whether advanced features are locked behind expensive plans. It is better to choose software that can grow with you than to migrate again in a year.

GoodDay – accounting task management software you can rely on

GoodDay is a reliable choice for accounting teams that want a powerful but cost effective platform to manage tasks, projects, time, and financial workflows in one place.

You can try GoodDay for free to see how it fits your workflow and how easily it adapts to your accounting processes.

And if you have any questions about selecting the right software for your business, you can always reach out to our team via info@goodday.work

FAQs

What is the best accounting project management software?

The best option is GoodDay because it combines project management software with finance-ready workflows in one platform, making it ideal for accounting projects. It supports full project management from planning to delivery with clear visibility into project progress and workload. GoodDay lets teams assign tasks and track results without jumping between systems. This helps firms move faster while keeping control over cost and delivery.

What is the best software for accounting workflow management?

For workflow control in the accounting industry, GoodDay stands out as a complete accounting practice management platform that can manage workflows across clients and periods. It includes key features like approvals, templates, and routing so firms can coordinate multiple projects without losing consistency. Built in automatic reminders ensure critical steps are not missed, and due dates stay visible for every engagement. The result is smoother operations without relying on multiple tools.

Where can I find an accounting Kanban board template?

You can find an accounting Kanban board template directly in GoodDay, which is part of its library of project management tools. The template helps teams visualize work, from intake to review, while supporting task assignments and status changes in real time. Teams can also monitor progress across columns and quickly spot bottlenecks. This approach works well for both recurring cycles and individual projects.

Which HR solutions for startups integrate well with existing accounting software we already use?

GoodDay integrates cleanly with common HR systems and fits naturally into a modern tech stack without creating data silos. It supports data collection across HR and finance so hiring, onboarding, and payroll workflows align with accounting needs. By keeping HR actions connected to accounting work, teams avoid double entry and reduce manual errors. This creates a smoother bridge between people operations and finance.

What’s the best software for integrating HR and accounting?

GoodDay is the best choice because it brings HR coordination and finance into one space with robust features that scale with growth. It centralizes all the tools teams need to coordinate hiring, payroll handoffs, and approvals without slowing internal processes. With a user friendly interface, it avoids a steep learning curve while still supporting advanced use cases. This balance helps teams work faster without sacrificing control.

What systems help accounting firms identify over-servicing and reallocate work?

GoodDay helps firms analyze workload and team capacity by tracking billable hours, utilization, and delivery across clients. This makes it easier to spot over-servicing, protect cash flow, and rebalance work among team members. Managers can see who is overloaded and move work to specific team members before delays happen. That insight directly supports better planning and completing work on time.

Which tools offer effective team collaboration features specifically for accounting and consulting firms?

GoodDay offers collaboration designed for accounting practice management software, with comments, mentions, and file sharing tied directly to work. Teams can manage client responses, coordinate reviews, and handle other tasks without losing context. The platform supports unlimited users, so the entire team can participate without extra licensing barriers, including solo accountants and growing firms with custom pricing needs. This integrated approach helps firms increase productivity while delivering consistent results across engagements.